The Digitalization of Banking: A Pathway to Financial Success

Introduction

Digital transformation is changing the face of banking, integrating technology into all business processes toward efficiency improvement and elevated customer experience. Traditional banking models are rapidly changing with the aggressive yet needed adaptation of data-driven methodologies, AI (artificial intelligence), IoT (internet of things), and other technological innovations to stay on top of the game. The article discusses the changes that digital transformation imposes on banking and its surrounding services, as well as challenges thereof, and lays out a pathway for the successful transformation of financial institutions.

Digital Transformation in Banking

Digital transformation describes the use of technology to upgrade the delivery of financial services, market shares, stakeholders’ engagement toward profiting, and customer engagement. Basically, digital transformation helps banks and financial institutions to provide better service to their clients and create more extensive operations toward their safety. It’s much more than simple automation; it’s a new way to think about corporate strategies to create a more agile, customer-focused financial ecosystem.

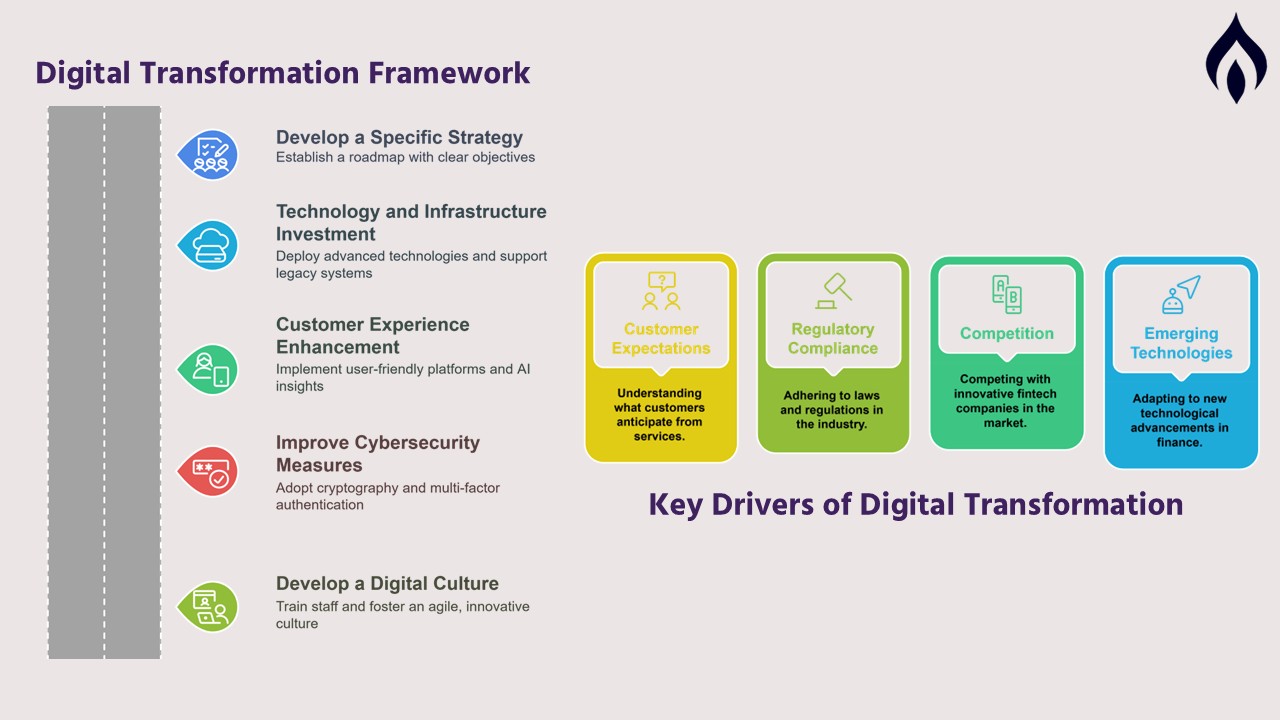

Key Drivers of Digital Transformation

- Customer Expectations

Customers now demand seamless, personalized banking experiences across all digital channels. AI-powered chatbots and digital banking applications are used to enhance customer engagement.

- Regulatory Compliance

Financial institutions must incur changes in their operations to be in line with evolving digital regulations. Data protection frameworks such as GDPR help secure customer transactions.

- Competition from Fintech Companies

Fintech startups are disrupting traditional banking models. Hence, the banks should innovate to stay relevant in the very fast-paced financial sector.

- Emerging Technologies

AI, IoT, and blockchain usher in a new era for banking services. Digital transformation allows predictive analytics, fraud detection, and automated transactions.

The Role of AI and IoT in Banking

Artificial Intelligence (AI) in Banking

AI is a synonym for disruption in the world of banking, with new and improved analytics, automation, and customer personalization. Some of the largest applications are:

- Chatbots & Virtual Assistants: AI-enabled chatbots provide real-time support with real-time responses for customer support and financial advice.

- Fraud Detection: Algorithms work in AI capability to use past transactional data to detect any kinds of fraudulent activities.

- Risk Assessment: Improving credit risk assessments with AI, thus providing additional enhancements to the credit approval process.

IoT in Banking

With connected devices, the Internet of Things (IoT) enhances banking by enabling the collection of real-time data. It contains applications such as:

- Smart ATMs: IoT enables ATMs to be a lot more secure and predicts maintenance needs.

- Connected Banking: Wearable technology allows the very same devices users to securely perform numerous financial transactions.

- Asset Monitoring: By making use of IoT sensors, banks can track assets and improve security.

Data-Driven Banking: Leveraging Big Data for Better Decision-Making

Attributing data to digital transformation, it helps banking institutions to gain insights into customer behaviour and market trends. Banks have started to deploy these big data analytics in:

- Personalized Services: By analysing customer data, you will be able to provide tailor-made financial solutions.

- Enhanced Security: And make the real-time monitoring of data run and prevent any chances of fraud or cyber threats.

- Optimized Operations: Predictive analytics is used to streamline business processes and lower costs.

In developing a digital transformation framework, banks must employ a strategic roadmap that aligns information technology with specific business goals. A structured approach has the following components:

1. Develop a Specific Strategy

- Develop a digital transformation roadmap with set objectives.

- Align the transformation initiatives with business and finance objectives.

2.Technology and Infrastructure Investment

- Deploy AI, IoT, blockchain, and cloud computing.

- Ensure that all legacy systems can accommodate support for digital banking solutions.

3. Customer Experience Enhancement

- Choose easy-to-use digital banking platforms.

- Use insights driven by AI to engage customers.

4.Improve Cybersecurity Measures

- Adopt cryptography and multi-factor authentication.

- Develop robust policies on the part of cybersecurity that would protect customer data.

5. Develop a Digital Culture

- Encourage the Staff to be trained on the use of digital technologies and tools.

- Adopt corporate culture that would accommodate agile and innovation-driven operationality.

Emerging Challenges to Digital Transformation in Banking

All these benefits notwithstanding, digital transformation in banking creates some challenges like:

- Legacy Systems: A legacy system will make the task of developing a fully integrated digital bank that much harder.

- Cybersecurity threats: As attacks and threats ramp up, robust methodologies for online and mobile security will become important.

- Regulations to conform to: The mix of high complexity and rapid evolution of compliance requirements has been an obstacle in the path of digital transformation.

- Customer resistance: Some customers refuse to switch from traditional banking to digital solutions.

All indications point to the digitalization of banking in the future through ongoing innovations in AI, IoT, and data analytics. Some of the emerging trends are as follows:

- Open Banking: APIs are allowing third-party developers to offer innovative financial services.

- Adoption of Blockchain: Decentralized ledgers for more security and transparency.

- Hyper-Personalization: AI-driven insights result in ultra-customized banking experiences.

- Autonomous Banking: AI-based automation reduces the need for human intervention in financial transactions.

Conclusion:

The process of digitalization in banking has now graduated from a mere option to become an urgent necessity due to the threat posed by the competitive financial landscape. It is only through an intelligent and reliable leap toward innovation that banks can successfully usher in a new phase of digitalized services, reinforce security measures, and propel corporate growth. A mentioned roadmap promises to ease organizations into the digital future with aggressive posture towards growth in the long run. Buoyed by advanced decision-making concerning liquidity and lending policies, this may allow them to consider an innovative, customer-centric, and tech-driven banking experience.

Add a review

Your email address will not be published. Required fields are marked *